Worlds Collide: Traditional Sport x Esports

The COVID-19 pandemic saw sports events grind to a halt following lockdowns and restrictions. However, whilst traditional sport faltered, esports operated at close to full capacity. Requiring only a consistent internet connection and a gaming device, over the last few years esports has continued to grow on a stable trajectory, with the ability to pivot to an ‘online only’ model paying dividends.

Catalysed by esports’ agility during the pandemic and wanting to take advantage of its rapid growth and engaged fanbase, sports teams have shown an increasing interest in their virtual counterparts.

To explore this increasing interest, we surveyed 1300 sports teams of various disciplines across 97 leagues around the globe. This article sets out our key findings on that data, including which sports are most involved in esports and what form that involvement has taken, before looking at an esports venture that has been executed with particular success, and explaining why esports are an essential part of the future of traditional sport.

Which sports are picking up the controller?

Of the 1300 sports teams analysed, 57% (740) were currently involved in esports in some capacity, either having formed their own team or having made an investment in esports through an alternative venture.

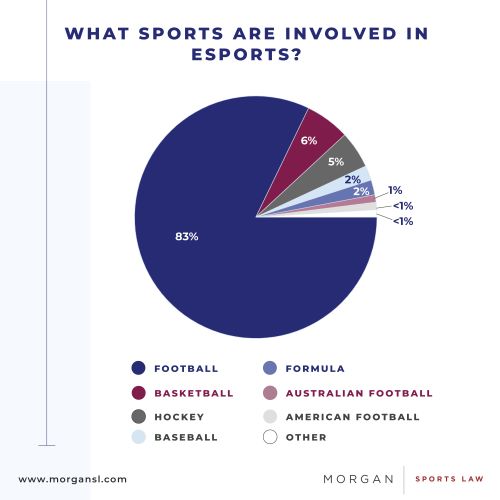

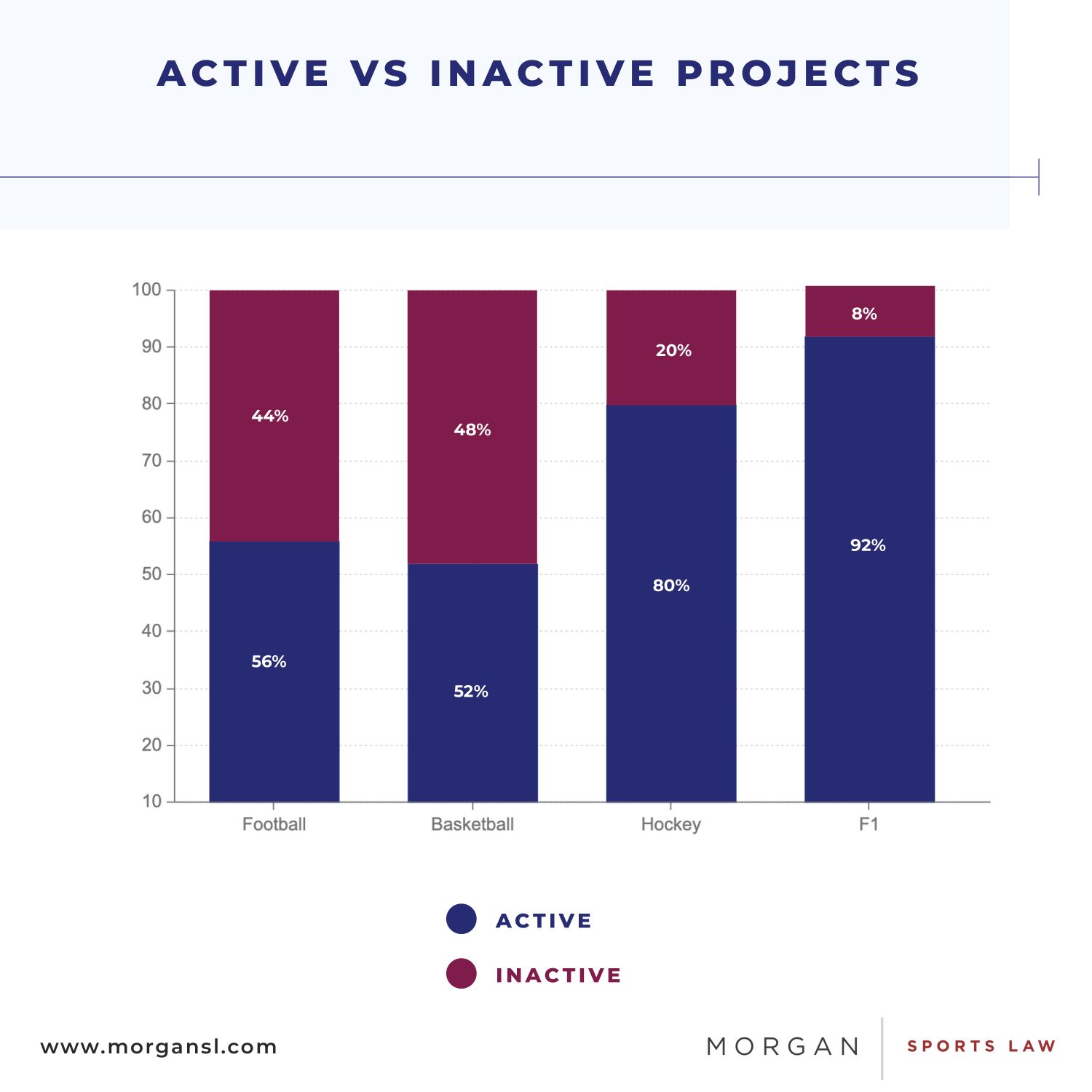

Sports teams were far more likely to have entered esports where a virtual game version of their traditional sport existed, for example in titles like FIFA (football), NBA 2K (basketball) and the F1 2021 (Formula 1). Of the sports teams, football teams made up the overwhelming majority of esports ventures (83%), with the next most involved sport being basketball (6%). That said, those ventures have had mixed success, with almost half of football and basketball esports ventures no longer being active.

Creating a team from scratch

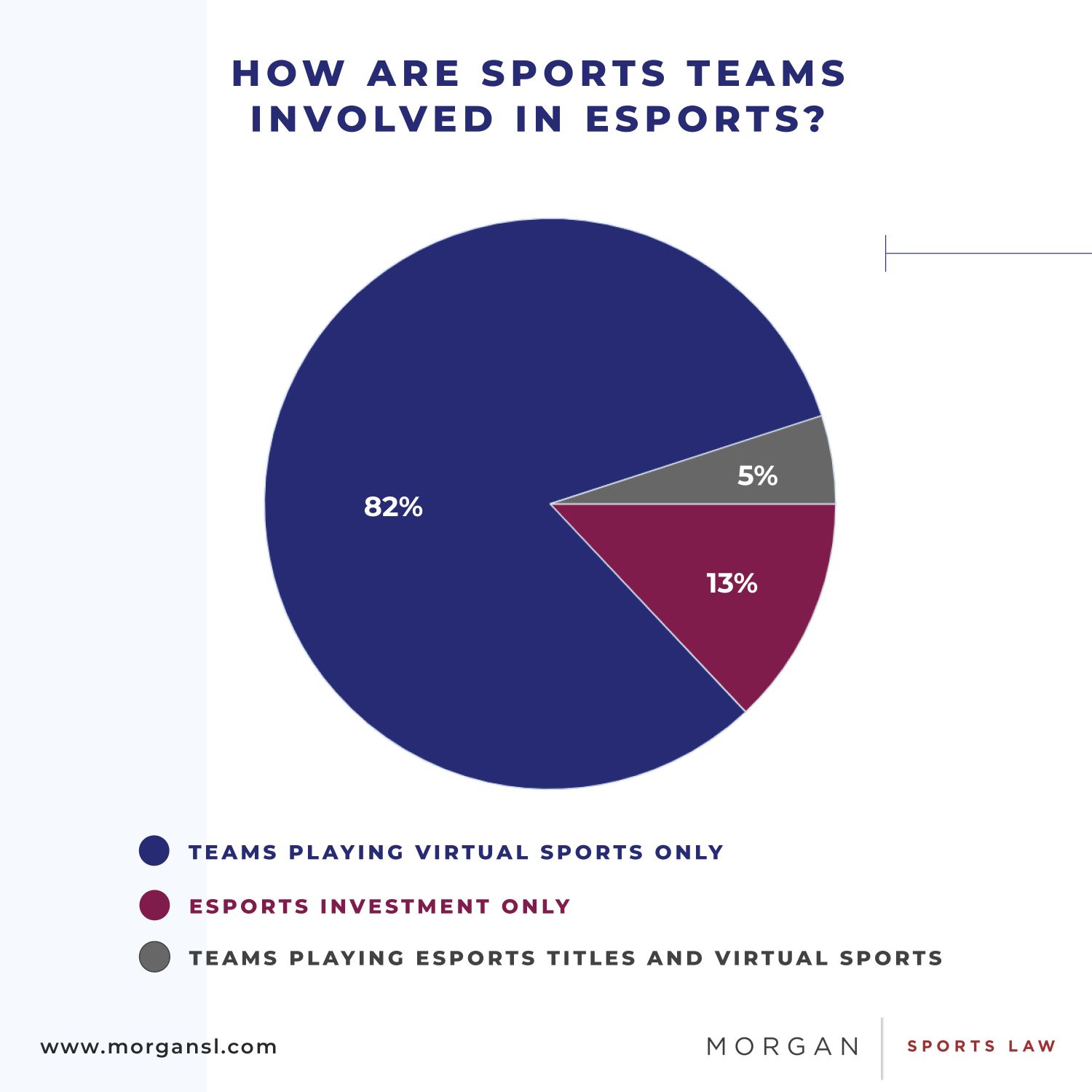

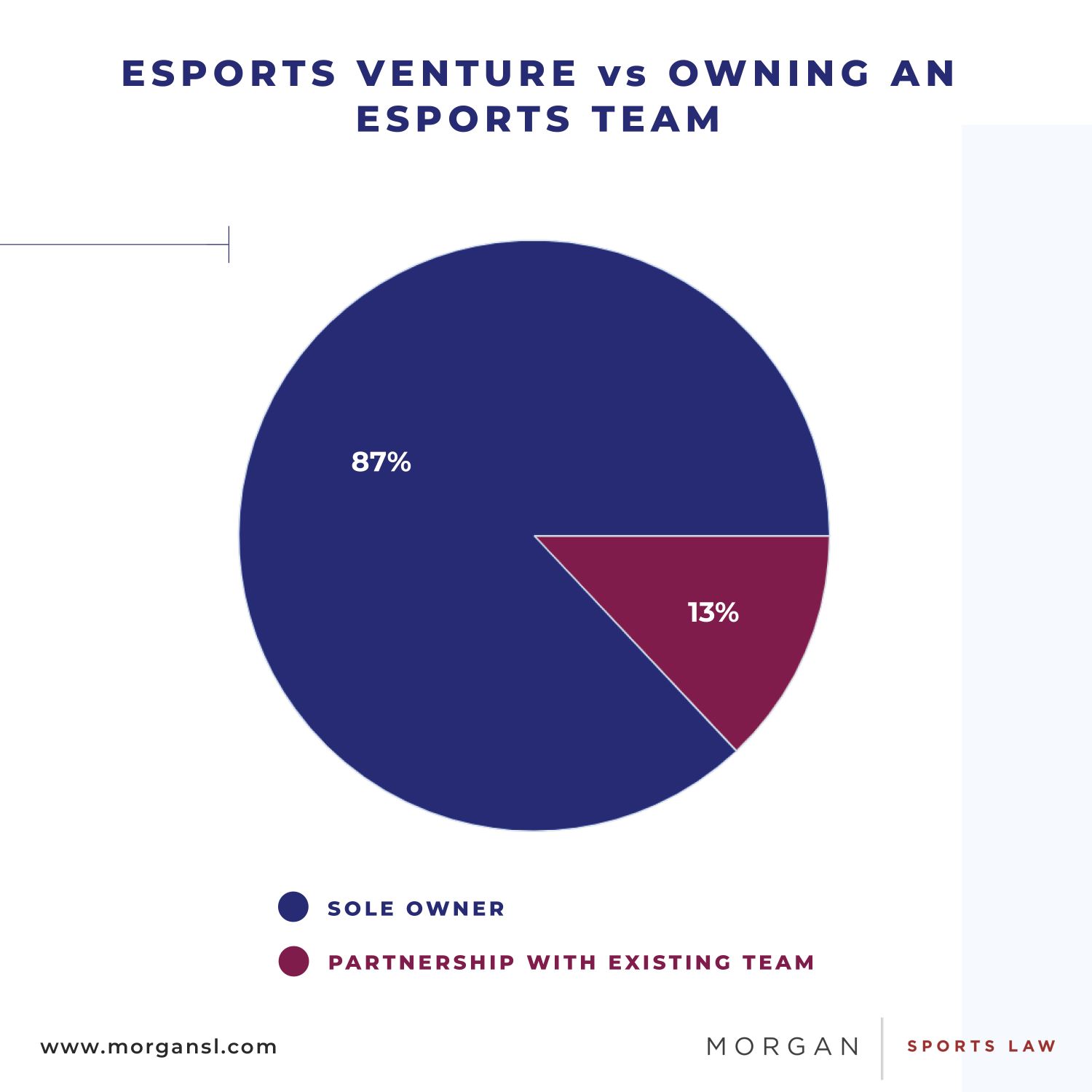

The data also revealed that the majority of esports-active teams (87%) opted to create their own esports team, rather than sponsor or partner with an existing team. Whilst this is a striking figure, it is important to note that 82% of those teams are involved solely in titles that are the virtual versions of ‘traditional’ sport.

There are many reasons sports teams may have opted for this approach: a lack of knowledge about esports and caution over their brand image to name but two. The choice to focus on games which are a virtual version of the sport played by the existing team is an easy one to justify to stakeholders who might not be familiar with titles like League of Legends or Counter-Strike.

However, it arguably also represents a missed opportunity for those teams. Even for titles like FIFA, the fanbase for virtual versions of real sport is dwarfed by the fanbases for Tier One esports titles. Nonetheless a small (but growing) number of sports teams that have entered the esports space (around 5%) have engaged with the major esports titles rather than virtual sports alone.

Many of these teams have seen fast returns on their investments and have shown that they have value beyond a mere marketing initiative. One such example is the German football team FC Schalke 04 (S04), whose League of Legends team finished in the top 4 of the European Championship (LEC) three times in the last 4 years, most recently coming 4th in the 2021 LEC Spring Split.

S04’s esports venture was so successful in fact, that it overshadowed the achievements of its parent football team, who was relegated in 2021 from the Bundesliga to the second division of professional football in Germany. This ultimately resulted in S04 selling their spot in the LEC for €26.5m to Team BDS, having purchased it for just €8m 3 years earlier.

Investment

An alternative route taken by some has been to partner or invest into esports, rather than own and operate a team directly. Some teams have chosen to enter into a partnerships with organisations already operating in esports (e.g. FC Köln and SK Gaming), whilst others have hosted esports tournaments for other teams to participate in (e.g. New York Islanders hosting an EA Sports NHL Tournament).

Only 13% of the teams we surveyed opted to take this route. Reasons for this are likely to reflect those contributing to the decision to engage through virtual sports rather than Tier One esports titles: a hesitancy to fully commit to the space, and perhaps a lack of in-house knowledge of the esports landscape, opportunities, and suitable options.

Success story

Probably the most important considerations for sports teams looking to enter the esports space are the geographic region they wish to target, and what resources (time and financial) they wish to put behind their investment.

PSG Talon, a partnership between the football team Paris Saint-Germain (PSG) and Hong Kong based League of Legends team Talon Esports, is a prime example of how an esports venture can target a new market whilst managing the scale of the investment that is made.

This multi-year partnership saw the newly branded PSG Talon play under a new logo featuring the PSG badge, exposing PSG’s brand to the Asian market and accelerating the success of Talon, whose fans received the partnership favourably.

The investment came with high expectations attached PSG Talon’s performance, with the Managing Director of PSG for Asia Pacific quoted as saying, “We look forward to challenging within the PCS and hopefully the World Finals too”. Those expectations were met. Since PSG Talon’s inception in 2020, they have played in two World Championships, the international Mid-Season Invitational, and won two Pacific Championship Series (PCS) splits.

Although the team was already performing well as Talon Esports, having won a PCS split and a regional tournament called the Mid-Season Showdown, the partnership has cemented that success and translated into repeated showings on the global stage. With that success has come positive exposure for the PSG brand around the globe.

The keys to the castle

Esports audiences are largely unreachable through traditional TV-based or out-of-home sports marketing campaigns. They are generally tech-savvy, online-based consumers that are saturated with content they want to watch and participate in. Their numbers are also growing exponentially, with new generations of esports fans adopting similar habits of content consumption, and becoming harder to reach, for sports teams that are still looking to grow their fanbases and build loyalty.

Many sports teams have ageing and waning fanbases, and effective engagement with esports is likely to be the key to their continued success and survival. Beyond the ability to tap into a community that rejects traditional channels of advertising, the apparent lack of location-specific fanbases to esports also opens a door to building a more global brand.

Equipped with effective knowledge, the opportunities for sports teams to succeed in esports are plentiful but only if they involve themselves in a way that is authentic. Proper education and familiarity with the space, knowing the best points of entry, and showing fans you care about their passion point will reap the best rewards.

Authored by

Nick Williams

Barrister

Morgan Sports Law

Matthew McVey

Talent Executive

DotX Talent