A Premier League Salary Cap?

The debate over cost control in English football has intensified over the past 12 months, as the UK government seeks to introduce an independent regulator to combat perceived failings in self-regulation of the sport.

Although clubs’ revenue continues to increase – in 2022/23 overall matchday, broadcast, and commercial revenue increased by 11% to an all-time high of £6.1 billion – concerns persist surrounding the financial sustainability of the current high-spending model.

For instance, it was reported in April 2024 that current Premier League club debt levels are around £3.6 billion, and only three of the twenty clubs recorded a profit before tax in their 2023 accounts.

UEFA’s new Financial Sustainability Regulations (“FSR”), which are set to take full effect in the 2025/26 season, aim to introduce new cost controls. However, the Premier League is trialling its own measures, above and beyond the new FSR requirements, with a view to implementing more stringent financial regulations, including a form of salary cap, but these have, unsurprisingly, not been met with unanimous approval.

UEFA's Financial Sustainability Regulations (FSR)

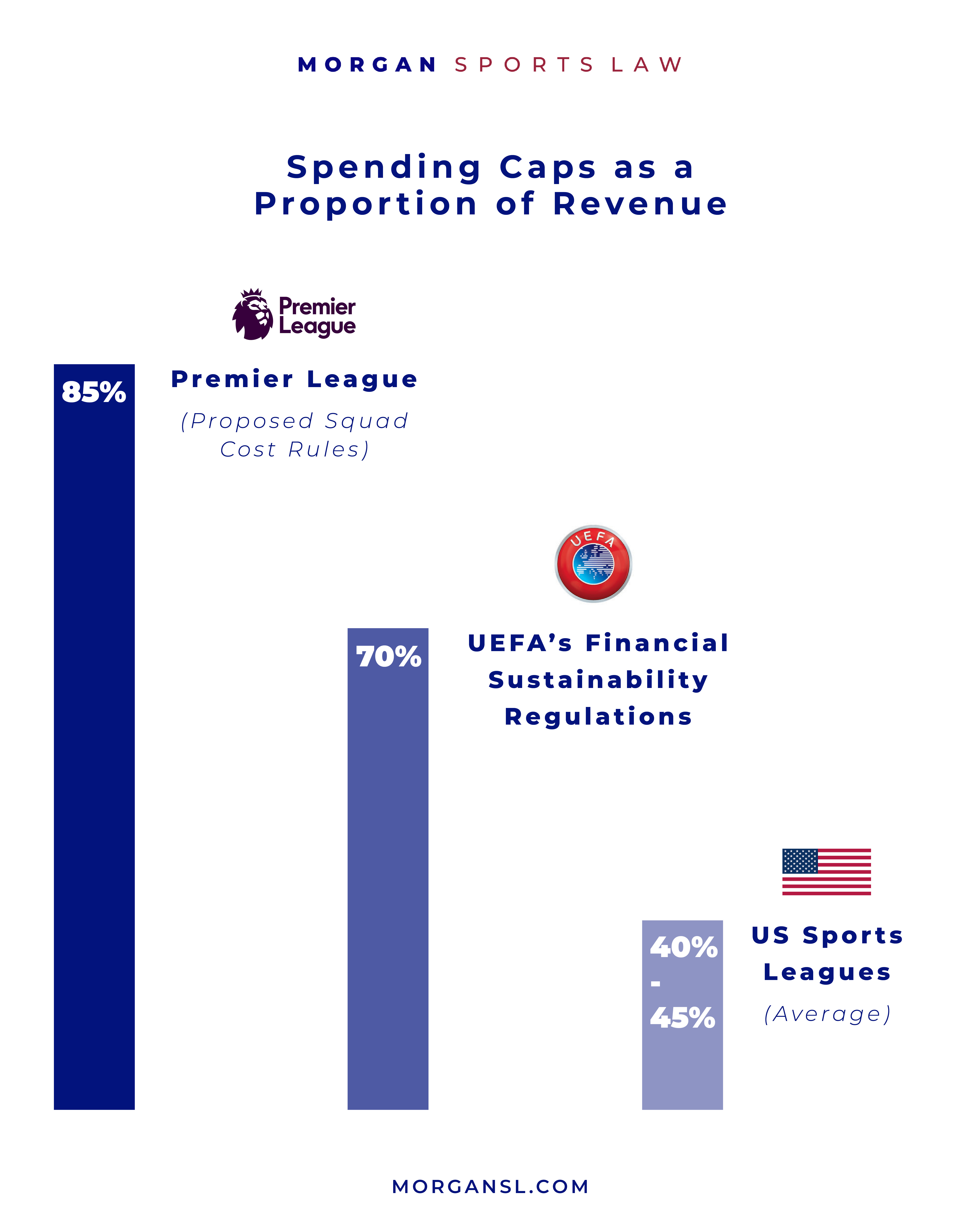

From 2025/26, UEFA’s FSR will cap spending on players, coaches, agents, and transfers at 70% of club revenue for those teams participating in UEFA club competitions (discussed further here). This might be regarded as a ‘soft’ salary cap – i.e., one which is relative to a club’s earnings.

However, compared to other professional sports, particularly in the US, where player spending typically hovers around 40-45% of revenue, UEFA’s 70% cap is still relatively high.

The Premier League’s proposed ‘Squad Cost Rules’

The Premier League is also considering introducing its own ‘Squad Cost Rules’, which would apply to all Premier League clubs.

The Premier League Squad Cost Rules, which are being trialled during the 2024/25 season, would set the spending cap at 85% of club revenue.

Whilst this is more lenient, it is designed to ensure that those Premier League clubs not participating in UEFA Club competitions (who are thus without access to the additional revenues derived from those competitions) will not be unfairly prejudiced.

However, although this limits the potentially anti-competitive effect of the FSR within the Premier League, there is a concern that such spending caps may perpetuate existing financial, and thus competitive, imbalances. As long as spending limits remain relative to a club’s revenue the status quo may be maintained.

Addressing competitive balance: Anchoring Rules

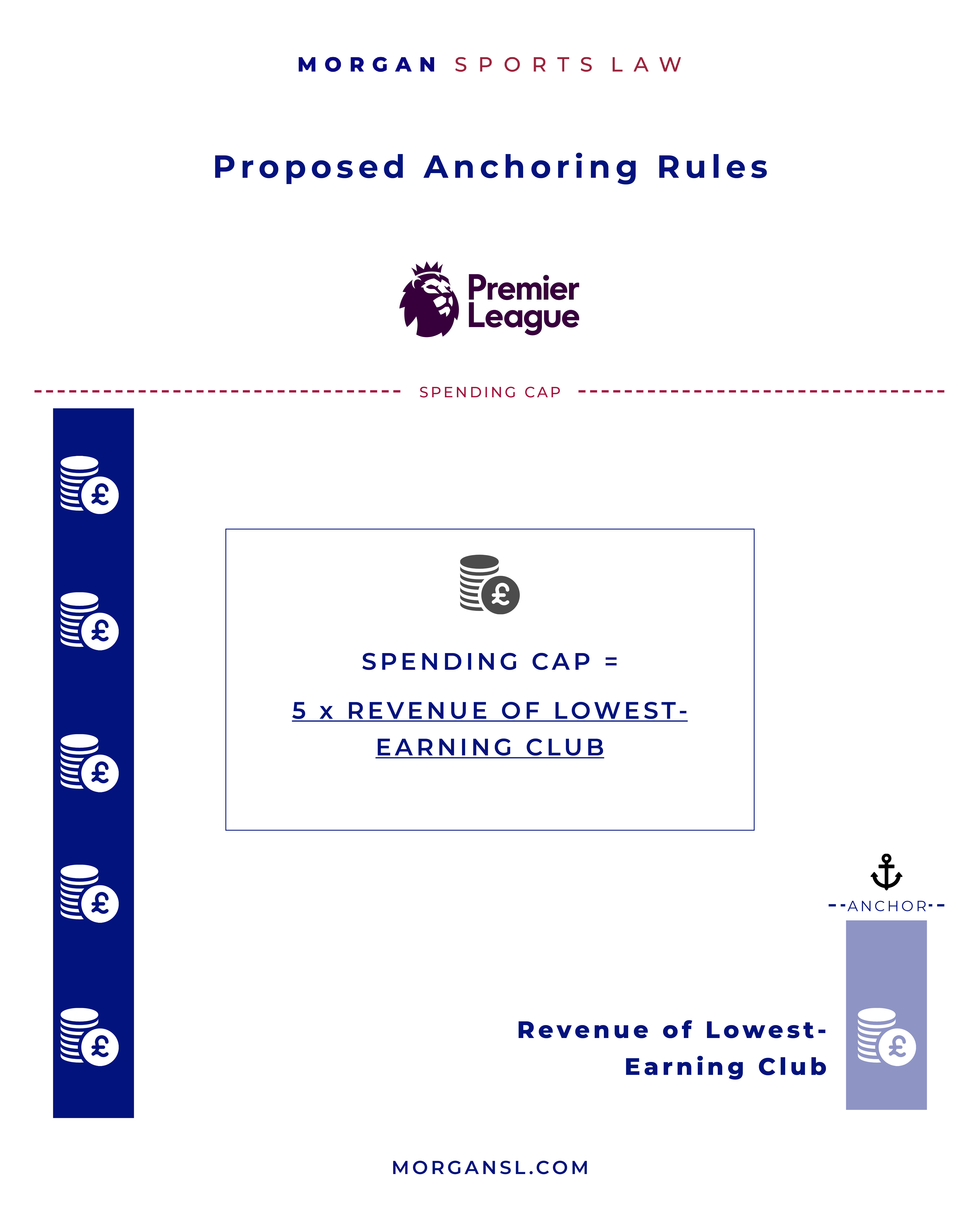

To address the lack of competitive balance, the Premier League is also trialling "anchoring" rules, which would set a ‘hard’ cap on club spending by reference to the centralised revenues of the league’s lowest-earning club.

Certain of the Premier League’s wealthiest clubs, and the Professional Footballers’ Association (PFA), are opposed to the idea and consider it to be an undue restriction of free-market competition. Indeed, a competition law challenge seems likely.

Under the proposed “anchoring” system, clubs would be allowed to spend up to five times the centralised revenue of the lowest-earning club, potentially leaving a significant financial gap between the top and the bottom.

However, would-be challengers of the proposed regulation may point to the fact that no Premier League club has gone bust in recent years, that revenues continue to increase, and that these rules would limit Premier League clubs’ ability to compete in the Champions League.

Of course, many US sports leagues, such as the NFL, NBA and NHL go even further and redistribute revenue equally among member clubs to ensure a level playing field and promote competition, on the basis that this is more commercially valuable and thus enhances revenues across the league.

However, the threat of relegation, and the existence of European-wide competition, makes English football a very different proposition to the closed-league model of US sport, where players’ interests tend to be carefully guarded by hard-fought Collective Bargaining Agreements.

Lessons from English rugby union

English rugby union has adopted a ‘hard’ salary cap for several years – although the level of the cap is not yet formally linked to club revenues – which has arguably helped to create competitive balance, but it has failed to prevent multiple club insolvencies.

It has also failed to ensure that all clubs are competitive – as there is no requirement to spend up to the level of the cap (discussed here).

This highlights the need for a more holistic approach to financial regulation.

In Premiership Rugby v. Saracens (2019), an independent panel concluded that Premiership Rugby’s salary cap regulations increase competition between clubs, and are designed to ensure financial stability, such that they are not unlawful under competition law.

However, it remains to be seen whether that finding would necessarily be upheld in the context of a legal challenge brought by players or clubs against the particular rules proposed by the Premier League.

Conclusion: striking a balance

The challenge for the Premier League is to create financial regulations that address perceived sustainability concerns, against the background of the creation of a new independent football regulator, without stifling clubs’ ambition or widening the gaps between clubs, whilst respecting players’ commercial value, in an increasingly saturated playing calendar.

In the meantime, clubs will need to be prepared to adapt their financial strategies to a changing regulatory landscape, whilst players and their representatives will need to be alive to the impact that such changes may have on the relationships between players and their clubs.

Authored by

Donna Bartley

Partner

Ben Cisneros

Associate